PUBLISHED EdgeProp | September 10, 2017

Many have faced off regarding whether freehold properties are better to leasehold ones, particularly as far as capital appreciation. The appropriate response may essentially lie in the entry cost. Inferable from their freehold legitimate life expectancy, freehold properties summon a value premium over similar leasehold properties. The inquiry is how to determine the reasonable premium.

In view of the Singapore Land Authority’s leasehold table, freehold properties summon premiums of around 4% to 10% over leasehold properties that have remaining leases of in the vicinity of 80 and 99 years. Genuine transactions, nonetheless, propose that paying premiums of up to 20% over equivalent leasehold properties is sensible.

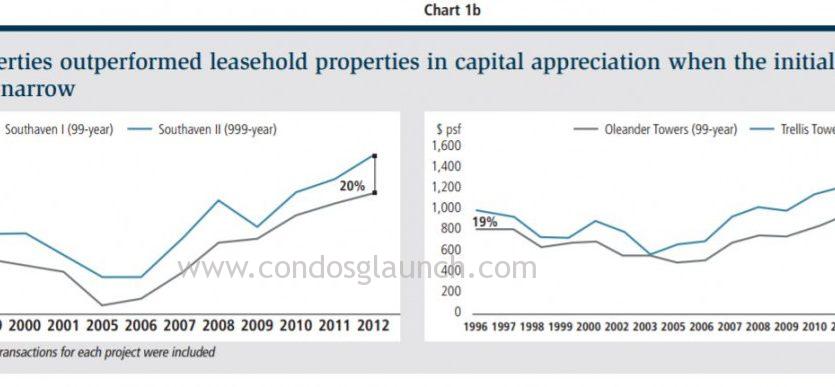

Southaven I and Southaven II offer a few pieces of information. The residential development are situated beside each other on Hindhede Walk and were completed two years separately. Be that as it may, Southaven I is on a 99-year leasehold site while Southaven II is on a 999-year leasehold site. This examination might regard 999-year leasehold as freehold. The price between Southaven I and II was 8% of every 1995, the most punctual date when official information ended up noticeably accessible. That year, 39 units at Southaven I sold for $634 psf and 83 units at Southaven II sold for $688 psf. The value hole extended to 20% by 2012 (see Outline 1a). Thus, costs acknowledged around 27% at Southaven I to $804 psf and 40% at Southaven II to $962 psf amid that period. In spite of the fact that the value hole varied after some time and hit 34% of every 2005, the middle remained at 20% in the vicinity of 1995 and 2012.

In Toa Payoh, the freehold Trellis Towers told an underlying value premium of 19% of every 1996 over the 99-year leasehold Oleander Towers. The value hole augmented to as high as 44% of every 2002 in spite of the fact that it limited again to 23% out of 2017, with a middle value hole of 31% in the vicinity of 1996 and 2017. Costs acknowledged 35% at Oleander Towers and 40% at Trellis Towers in that period (see Diagram 1b).

There is little facts that when the premium surpasses 30%, the capital appreciation for freehold properties could fall behind that for practically identical leasehold properties. In 2006, freehold One Jervois transacted an underlying value premium of 37% over the 99-year leasehold Domain 21 location nearby. An aggregate of 205 units at One Jervois were sold in that year at a average price of $1,004 psf as compared to the $731 psf got by 44 units at Domain 21. The premium fell throughout the years, with a middle of 16% in the vicinity of 2006 and 2017. Accordingly, the capital appreciation for Domain 21 beat that of One Jervois amid this period (see Graph 2a).

Additionally, prices at 99-year leasehold Amaryllis Ville climbed quicker than those at Newton 18, a freehold property situated adjacent. In 2002, 59 units at Newton 18 changed hands at a normal cost of $1,115 psf, or at a 31% premium to the 41 units sold at Amaryllis Ville, which went for $854 psf. The premium likewise reduced throughout the years, bringing about a median of 21% in the vicinity of 2002 and 2016. In 2016, costs arrived at the midpoint of $1,737 psf at Newton 18 and $1,434 psf at Amaryllis Ville, which converts into capital thanks of 56% and 68%, separately, since 2002 (see Outline 2b).

With a reasonable acceptance price, freehold properties offer a few key preferences. For one, the government has stopped to offer freehold land parcel available to be purchased. The shortage factor will make freehold properties an appealing resource class for homebuyers. At present, freehold properties represent around 49% of total private residential apartment and condominium stock in Singapore, while leasehold properties make up the rest of. The extent of freehold properties is set to decay as future launches will involve for the most part leasehold projects. Freehold apartments and condominium situated within strolling separation of a MRT station are considerably more restricted, representing only 13% of aggregate stock of whole Singapore (see Outline 3).

Certain foreign nationalities demonstrate an inclination for freehold properties. Between January 2016 and August 2017, 71% of transactions were for leasehold properties and 29% for freehold ones. The extent of freehold transactions, in any case, was higher among a few key foreign buyers, to be specific those from Indonesia (40%), the US (41%), the UK (half), Australia (half) and Hong Kong (34%). Freehold properties represented 60% of purchase by organizations.

Freehold properties are additionally said to have better en-bloc potential. A calculated relapse analysis demonstrates that tenure isn’t a measurably critical variable at the 5% level in deciding the achievement of an en-bloc deal. It is, notwithstanding, a monetarily critical variable with a substantial coefficient.

At long last, the danger of owning a leasehold property winds up plainly critical as the rest of runs low. To back a property utilizing the Central Provident Fund, the whole of the rest of the lease and the age of the purchaser must be no less than 80 years. For properties with outstanding leases of in the vicinity of 30 and 60 years, a valuation limit will apply on the measure of CPF commitment that can be utilized to fund the property. The financing restriction would shrivel the pool of potential purchasers for maturing leasehold properties. Then, en bloc isn’t an ensured choice for leasehold properties and there is a plausibility that the land will come back to the state toward the finish of a lease.

On the other side, the rental market does not varies between the sorts of tenure of the property. Leasehold properties offer higher rental yields over practically identical freehold properties, inferable from their marked down costs. The higher yields serve to adjust for their depreciating tenure, higher risk and shorter life expectancy to recover the proprietor’s capital cost.

Source: https://www.edgeprop.sg/content/freehold-always-better-leasehold

WhatsApp us

WhatsApp us