SINGAPORE – At 861 sq ft, it works out to $854 per sq ft – the third-highest amount paid last year for flats with less than 60 years of lease left. “It is a rare terraced unit in an area with a lot of character, and it does not feel like it is very old at all. We think it is a fair price,” said Ms Wong who is aged 44 years old.

Last Friday, National Development Minister Lawrence Wong, alarmed by a news report on old HDB flats that fetched high prices, sounded a cautionary note about such buying behaviour. Some appeared to have bought those units on the assumption that their flats will benefit from the Selective En bloc Redevelopment Scheme (Sers), he said in a blog post.

This is not so, he said. Only a small minority qualify for Sers, which compensates home owners for their flats and gives them new ones with fresh leases. The rest of the flats will return to the state when their leases expire.

In particular, he advised younger couples to buy a home “that covers you and your spouse to age 95”.

Mr Zhang, an IT engineer who sold of his newer 3 room flat in Clementi mention, “It wasn’t cheap, but I thought the value will keep going up,” also paid top dollar for an older home.

He bought this place because my daughter’s school is nearby and the location is good.

Last January, he paid $950,000 for his five-room Bukit Timah flat. It is 43 years old with just 56 years of lease remaining. This was last year’s record for an HDB unit with less than 60 years left on the lease.

Flats of a specific vintage are more well known on the resale showcase because of variables, for example, area – they have a tendency to be in develop homes – size and conveniences in the area.

Measurements indicate they represent a lopsided share of exchanges in the HDB resale showcase.

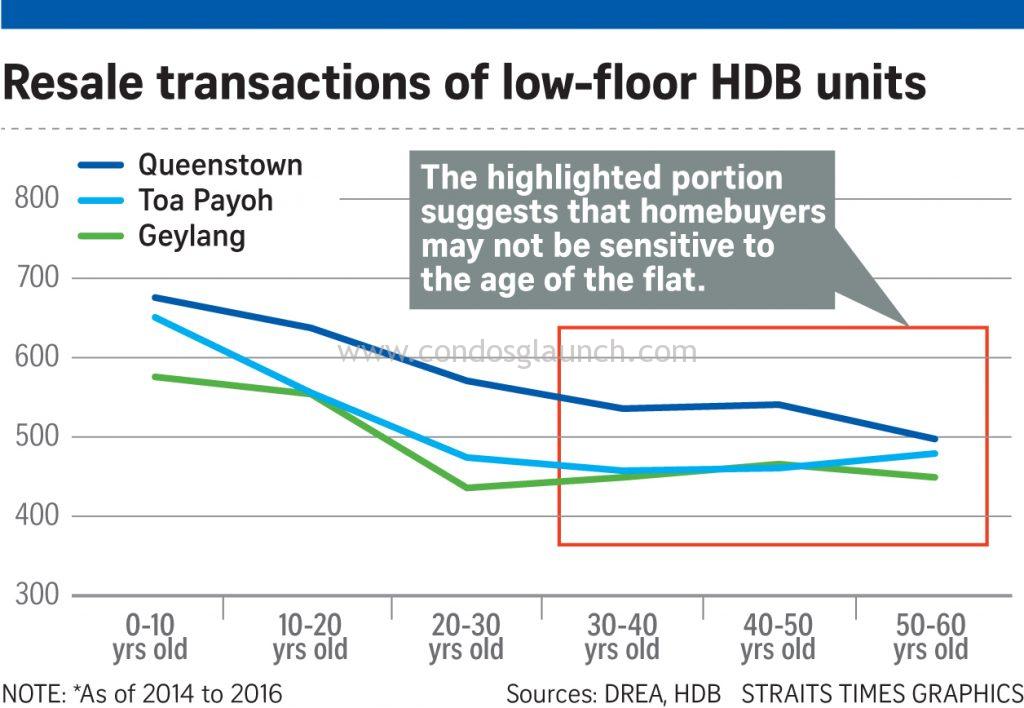

Half of all resales a year ago were of flat more seasoned than 30 years. This is despite the fact that such flat make up just around 33% of the HDB lodging stock.

Even flats older than 40 sell well, despite loan restrictions on how much buyers can withdraw from their Central Provident Fund to finance such purchases. They form 11 per cent of transactions from 2014 to last year, even though just 7 per cent of all HDB flats are of that age.

Sellers are confident to find buyers due to the rarity of HDB terraced units and given their prime location. Given the high price buyer paid for the resales HDB with more than 30 years lease. Buyers may check it out alternative to look at executive condominium, where they can to enjoy good efficient size as compared to new private condominium, affordable, enjoy full condo facilities and may enjoy up to $30k housing grant from the government.

Latest upcoming executive condominium launches include Hundred Palms Residences at Yio Chu Kang Road, Anchorvale lane EC and Sumang walk EC.

WhatsApp us

WhatsApp us