Observers say economic competitiveness makes S’pore less attractive B&R investment destination, but Asean’s resulting growth can help S’pore

PUBLISHED Tuesday, June 13, 2017

SINGAPORE and China vowed on Monday to collaborate on China’s infrastructural “project of the century”, yet eyewitnesses say the city state is probably going to get just a couple of beads from the surge of monies.

In any case, Singapore should even now attempt to position itself to get the rising tide of chances that China’s “Belt and Road” (B&R) activity can convey to Asean, they included. This will lift Singapore’s boat, as the city state tries to explore worldwide instabilities that may delay its development.

“China’s economy has moved on from grade school and is currently going to optional school, so there’s opposition with Singapore on the top of the line side, so the B&R investments are not liable to stream here,” said Tan Kong Yam, professor of economics at Nanyang Technological University.

“But the B&R is upgrading Asean’s infrastructure. And that can benefit Singapore’s companies looking for opportunities in the region,” he added.

The B&R initiative is apparently a free series of projects aimed at facilitating trade and investment flows between China and other countries, by investing in infrastructure.

The initiative offers China an opportunity to send out its abundance industrial capacity abroad, while developing the worldwide reach of its currency.

President Xi Jinping said that the venture of the century can profit people groups from around the globe.

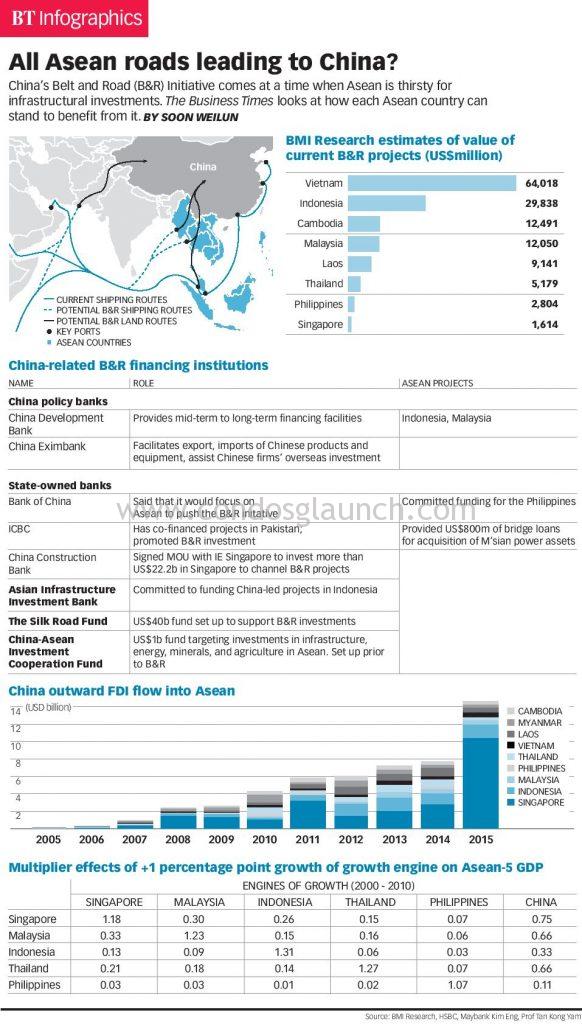

The B&R initiative comes when Asean is communicating a serious long for infrastructure financing. The Asian Development Bank assessed that the area needs US$5.5 trillion from 2015 to 2030.

There are initial signs showing that the initiative is quenching Asean’s thirst. Maybank Kim Eng economist Lee Ju Ye noted that since the B&R initiative was first introduced in 2013, China’s outward immediate speculations (ODI) into Asean grew by 7.5 per cent in 2014, and then surged by 87 per cent in 2015.

Singapore has gotten the vast majority of these Chinese ODI reserves. A Maybank Kim Eng report demonstrated that these streams into Singapore totalled about US$11 billion in 2015 – thrice the joined aggregate of what the other Asean economies gotten in that year. For that year, the assets streamed into administrations areas, especially renting and business administrations.

Be that as it may, don’t anticipate that Singapore will profit much from those assets, say observers.

“The city-state’s small size and developed status mean that the opportunities will not be in inward infrastructure investment,” said BMI Research infrastructure analyst Christian Zhang.

“Historically, it has been difficult for international companies to participate in China-backed infrastructure projects in Asia and Africa, and this will continue to be a challenge for both Singaporean and other non-Chinese companies around the world,” he added.

Observer say a large portion of the assets are utilizing Singapore as a regional financial hub to support other projects in the region

For instance, a tranche of Bank of China’s US$3.6 billion B&R-related bond deal in 2015 was designated in Singapore dollars and sold by means of Singaporean banks, noted HSBC financial specialist Joseph Incalcaterra.

Said Tony Cripps, CEO of HSBC Singapore: “The scale and size of the required speculation will definitely require private venture, and Singapore’s set up capital market makes it the regular framework back center point for the district.”

Yet, there is more in question for Singapore than attempting to catch that stream of B&R monies into Asean.

Urgently, the activity can possibly light up Asean’s macroeconomic viewpoint. This can support Singapore’s economy and organizations that are based here, said eyewitnesses.

Singapore’s Foreign Minister Dr Balakrishnan has highlighted to such an extent. He said in a China Daily meeting distributed on Monday that Asean “needs improved open foundation and network”. “The ‘Belt and Road’ activity supplements the Master Plan for Asean Connectivity.”

WhatsApp us

WhatsApp us